Supplier Portal

New & Improved Supplier Portal

Starting July 15, 2024, the updated UF Supplier portal will be available. This upgraded portal introduces a new user authentication system to bolster security measures:

· Existing suppliers do not need to take any action unless they need to make a change to their supplier file information (addresses, banking information, etc). In that case, the supplier will need to set up a User ID and password in order to submit the change request.

· New suppliers will establish their User ID and password during the registration process.

More information on the updated UF Supplier portal available here:

Supplier Portal Update PowerPoint

Required Human Trafficking Attestation Forms should be submitted via the Finance Hub.

For access to the new portal and comprehensive instructional guides, please refer to the links provided below.

The University of Florida welcomes suppliers interested in doing business with the university. We strive for an open and competitive process with our suppliers in order to foster a mutually beneficial relationship.

SUPPLIER PORTAL INSTRUCTION GUIDES

New BUSINESS Supplier Registration

New INDIVIDUAL Supplier Registration

Existing Supplier New User (This guide is for existing suppliers to add a user for portal access.)

Existing Supplier Change (This guide is for existing suppliers who need to update their supplier file information. If you have not yet created a User ID & password, follow the instructions for “Existing Supplier New User” before proceeding.)

Supplier Information

Use the Supplier Portal link above to register as a new supplier or make changes for an existing supplier.

Once a request is submitted through the portal, suppliers will receive a confirmation email. Upon approval by the UF Supplier team, new suppliers will be notified by email and will be provided with a UF Supplier ID. This is the final part of the registration/change process for suppliers.

To avoid the confirmation and approval emails being discarded by junk mail filters, we encourage suppliers to make the necessary adjustments to their email inbox settings to allow this message to be delivered. Suppliers and UF departments with questions regarding the onboarding process, requiring assistance completing the application, inquiring as to the status of an application or with any other supplier-related question or concern may contact us.

If a supplier does not receive a purchase order or payment from the university in a 12-month period, that supplier will be inactivated in the UF system and will need to resubmit a supplier application.

Foreign Suppliers

Since tax laws can differ from region to region, the review and approval of Payroll Services is required for Disbursements to process foreign suppliers. Please follow the information in the “Requirements for Payments to Foreign Nationals, NRAs and Foreign Corporations” directive and procedure to ensure compliance.

Required Supplier Information

The forms/documents below will be required. It is best to have these completed and available before beginning the registration process:

- Individuals – Signed Supplier Tax Information Form

- All Suppliers – Signed Human Trafficking Attestation Form

- U.S. Companies – Signed W-9

- Foreign Company – Signed W-8BEN-E

- Non-Resident Individual – Signed W-8BEN

If you are a certified small or minority supplier, a certification document will be needed.

The following insurance forms will be needed if required (see UF’s Procurement website for more details):

- General Liability Insurance

- Worker’s Compensation

- Vehicle Insurance

Payment Method

UF currently requires all US suppliers to accept payments via Automated Clearing House funds transfer (ACH) or via wire transfer. When registering, you may only select from these two payment methods from the dropdown menu. Exceptions to this policy may be made on a case-by-case basis. Such requests for exception should be thoroughly explained in the comment section for consideration.

A signed Electronic Payment Authorization Form or Bank Wire Form must be completed, signed and attached to the registration with the correct banking information. One of the following forms must also be submitted for account verification:

- A voided check which confirms the account/routing number on your form. No starter checks accepted.

- A copy of the bank statement that lists and confirms the account #, bank name/routing # and account holder’s name.

UF also participates in Bank of America’s ePayables program. Enrollment will allow UF to remit payments to you faster via single-use credit cards. Please note that you must be able to accept credit card payment and there is a fee associated if you select this option.

If you would like to participate in the ePayables program, leave the Payment Method and Banking Information blank and add a note in the comment box at the bottom of the Payment Information tab during registration letting us know of your choice.

Additional Information for Suppliers

Change in Employer Identification Number or Tax Identification Number

Any change to a supplier’s Employer Identification Number or Tax Identification Number, will require a new supplier registration through the supplier portal.

Invoices

Upon completion of performance of services or provision of goods, please submit all invoices for work completed to the myUFMarketplace.

Mail:

University of Florida

Attn: Accounts Payable

PO Box 3357

Scranton, PA 18505

Fax:

1-570-496-5411

Email:

UFL.invoices@trustflowds.com

The file must be attached to the email and not embedded within the email. There can be multiple files per email but each file should only contain one invoice. The invoice must contain a valid UF Purchase Order number or an eight-digit UF department identification number of the department to which you are providing the goods or services.

Additionally, all payment questions should be routed to University Disbursement Services.

Information regarding Government Classifications and Supplier Certification:

Suppliers interested in becoming certified with the State of Florida or who have questions concerning Government Classifications should contact the UF Small Business Relations.

UF Departments Use Only

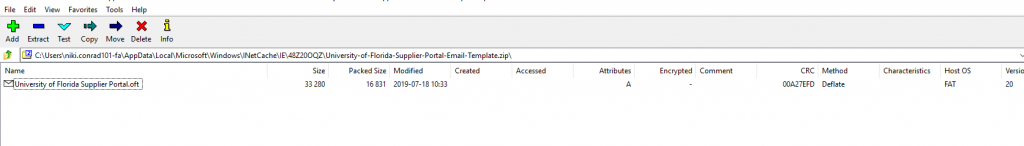

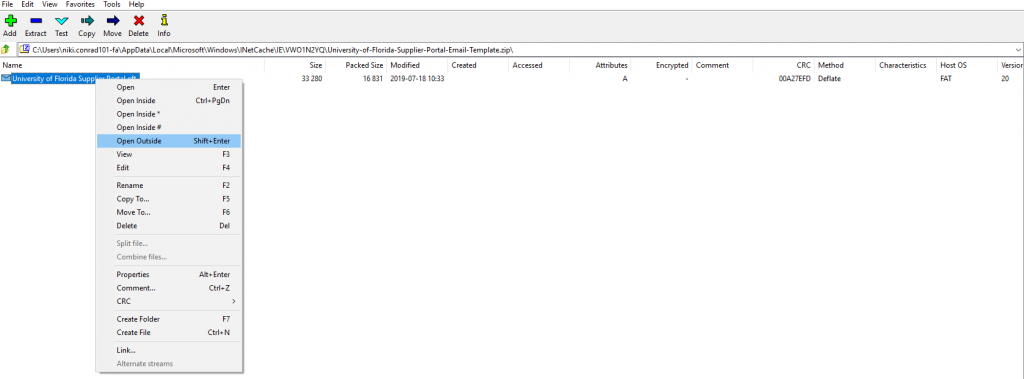

For a supplier to register or change their existing information with the University of Florida, send an email to the supplier directing them to this website. An email template is available for departmental use when inviting suppliers to our portal. Follow the steps below to download the email template.

- Download the UF Supplier Portal Email Template

- Unzip

- Select the .oft file

- Right-click and select “Open Outside” to open it in Outlook

Contacts

Disbursements: (352) 392-1241

Last Reviewed

Last reviewed on 06/28/2024