Payroll Distributions – Fiscal Year-End Rollover

Directive Statement

This directive establishes the proper methods of processing the fiscal year-end rollover of department budget tables/distributions.

Reason for Directive

All payroll distributions (also called department budget tables or DBT) for active employees will be carried forward on the “rollover” date in June of the current fiscal year to the next fiscal. The actual rollover date will be communicated through the PY Distribution Listserv, FY End Memo sent via Administrative Memo and in Finance & Accounting Year End Meetings.

On the rollover date, the system will save the department budget tables, without activating or posting them. Departments are then responsible for activating all of the distributions (DBT) by the deadline, usually a few weeks after the rollover. This timing gives departments time to review the distributions (DBT) for accuracy, as many distributions are likely change with the start of a new fiscal year.

Who must comply?

All UF departments.

Important Deadlines

- You will be notified via PY Distribution Listserv of the deadline for entering department budget table changes for the current fiscal year. You will also be provided the deadline for submitting payroll cost transfers (retros) for corrections to state related funds for the current fiscal year

- Please pay close attention to these deadlines, as no prior fiscal year department budget tables may be created after start of the new fiscal year

- Therefore, once the deadlines have passed there is no recourse to correct prior year state-funded payroll expenditures so that these charges occur in the ending fiscal year

- Once the fiscal year has closed and we are completely in the new fiscal year, all charges will go to the current DBT, whether or not the payment is for prior year dates

Overview

After the rollover is complete, a list of department budget tables (DBTs) will be sent out periodically to the PY Distribution Listserv for employees and department defaults that are inactivated or missing distributions.

The Department (Default) DBT is the default distribution for a department, and must be activated for any department with distributions needed in the new fiscal year. In addition, employees will have individual DBTs that need to be activated if needed in the new fiscal year.

All DBTs are not automatically activated during the rollover for the following reasons:

To prevent department budget tables from activating that shouldn’t be activated.

Example: When a termination is in process but not fully approved until after the rollover.

- Once approved (assuming the employee is terminated 6/30 or prior), no department budget table is necessary in the new fiscal year, as this person will no longer be an employee

- If activation was automatic, there would be unnecessary department budget tables

In this case: the department would NOT activate the department budget table and allow it to be deleted in the mass deletion that occurs in mid-July of any inactivated department budget tables

Project begin and end dates

- During the review, department processors should review DBTs to ensure that they do not have an employee distributed on an expired grant

- If activation was automatic, this problem would not be identified

- In addition, if a project ends before end of fiscal year then a contingent combination code would be needed to complete the DBT through the end of the fiscal year

Employees could be incorrectly deactivated

- After the activation deadline has passed, the system deletes all inactivated DBTs

- If these were deleted and you actually did need these, then you will have to manually create these department budget tables

Procedures

- Review the attachment(s) in the e-mail for:

- Employees no longer in the department (terminated, retired, etc.) Keep in mind, it is strongly recommended to activate faculty positions, to avoid the additional work of creating DBTs after they are deleted

- Changes in distribution for the new fiscal year

- New employees that need to be added

- After determining which department DBTs and employee DBTs need to be activated, follow the steps in the appropriate section below

Department Default DBTs

There must be a department default DBT for all departments that have payroll. “Activate” and “Save” departments that have payroll. If a department ID is no longer active, please do not activate and email payroll-services@ufl.edu.

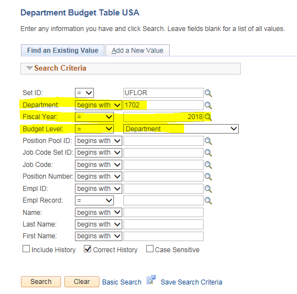

- Navigate to: Main Menu > Human Resources > Set up HCM > Product Related > Commitment Accounting > Budget Information > Department Budget Table USA

- Fill out the following information:

- Open each department DBT and verify that the default combination code is correct

- If the default combination code needs to be updated and you are unable to make the change, please e-mail the correct combination code to payroll-services@admin.ufl.edu and Payroll Services will correct

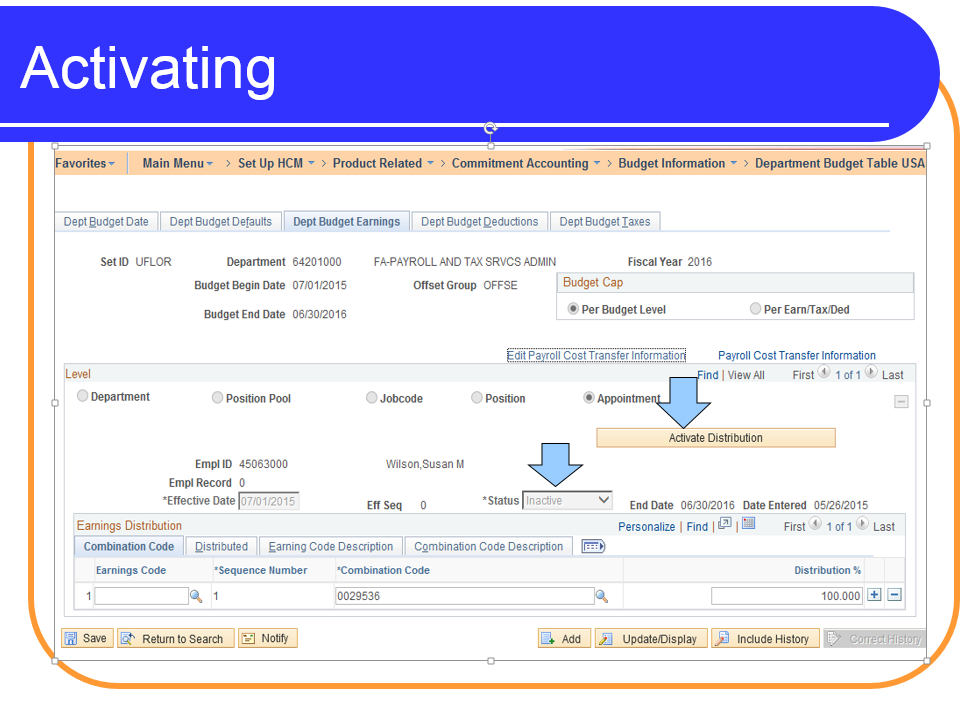

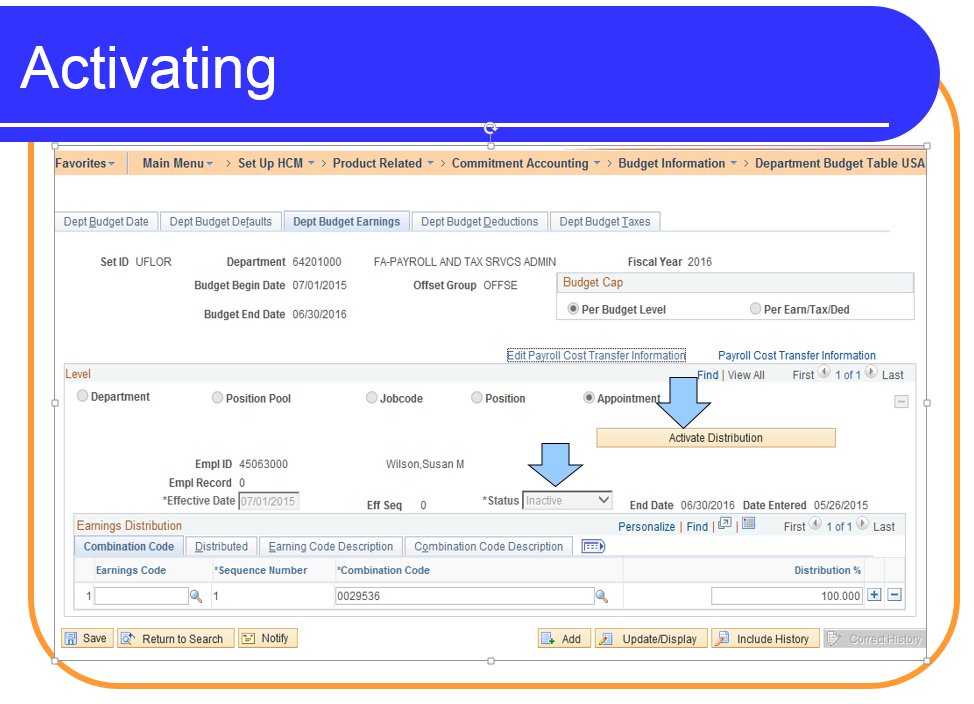

- For ones that are correct and will have salary expenses in the new fiscal year, click “Activate”

- Any department IDs that were not activated will be included in the mass deletion that occurs after the deadline

Employee DBTs

Reminder: “Activate” and “Save” only employees who will have payroll activity in the new fiscal year.

Active Employees

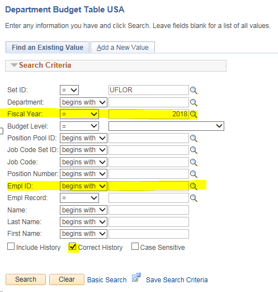

- Navigate to: Main Menu > Human Resources > Set up HCM > Product Related > Commitment Accounting > Budget Information > Department Budget Table USA

- Fill out the highlighted areas with the new fiscal year and Employee ID:

- Review the employee’s distribution to ensure it is correct for the new fiscal year. Activate the DBT before making any edits.

- Click “Activate” and “Save”

- After activating, all lines will show as “Active” and you can make any needed edits

Terminated Employees

DBTs for terminated employees do not need to be activated. After the deadline for activation, a process is run to delete the inactivated department budget tables and the DBTs for terminated employees will be deleted.

Please note the following special circumstance:

If the employee’s termination is set to occur at the end of the current fiscal year and the termination is not in Job Data when the first pay period in the new fiscal year is processed for payment, then the employee would still appear in the system.

In this case, if Time & Labor is not corrected manually, the employee could accidentally be paid

- If the employee is paid, the payroll might go to a department default chart field as you would not have activated new FY department budget table for this employee if during the crossover pay period or it is possible that the pay may be turned off and not paid at all

- Otherwise, after the fiscal year cross over pay period it will be charged to the current year’s department budget table at the time of payment

New Hires

- For new hires set up in Job Data by the deadline indicated in the PY Distribution Listserv email, confirm there is a department budget table for the fiscal year that is just ending

- If not, a distribution will need to be entered for both the fiscal year just ending and the new fiscal year before the close of the first pay period of the new fiscal year

- This is especially important in years with a “cross-over” pay period – part in one fiscal year and the rest in the next fiscal year. In this case, if there is a not a DBT for the fiscal year that is ending, it is possible that the part of the pay from that fiscal year will be “turned off” and not paid, or that the employee will be paid but the funds will be charged to your department default DBT

- For a cross-college distribution, complete the Payroll Distribution-Retro Request Form

- Send the completed form to the College/VP level area staff to process, based on the College-VP Area Level Office Staff List or to Payroll Services as indicated in the year-end instructions sent to the listserv by the deadline indicated

Editing or Correcting a DBT

Reminder: Do not make any edits until you have clicked “Activate” and “Save”

- After activating, make any changes to the DBT and then “Save”

- If you are unable to make the change, please e-mail payroll-services@ufl.edu

Definitions

Distributions

Distributions are part of commitment accounting, and are used to identify the funding source for an employee.

Last Reviewed

Last reviewed on 06/28/2024

Toolkits

UF HR Toolkit – Commitment Accounting

Contacts

Payroll Services: (352) 392-1231

Recruitment & Staffing: (352) 392-2477

Academic Personnel: (352) 392-2477

Student Employment: (352) 392-0296

UF Help Desk: (352) 392-HELP