- Homepage

- Initiatives

- UF GO

- Travel and Expense

- Directives

Directives

Overview Traveler Types Travel Classifications Travel Requests and Booking Travel Expense Reports Travel Expenses Special Considerations General Reimbursement

Overview

Travel on University business and for research, education and public service activities is a valuable and necessary activity for many of the University’s faculty, staff, and students as well as for official business visitors. Travelers should neither gain nor lose personal funds because of business travel on the University’s behalf. Expenses incurred for business travel and other business expenses are reimbursable when properly documented, approved, and in compliance with policies, directives and regulations.

The University uses UF GO, a cloud-based solution powered by SAP Concur, as an integrated platform that provides seamless processing for all stages of travel, including Travel Requests, Booking, and Expense Reports.

The purpose of these directives is to provide guidelines to ensure:

- Travel follows all legislative requirements of the State of Florida

- The University and the traveler follow Internal Revenue Service (IRS) regulations that define the types of expenses that can be reimbursed without being counted as taxable income

- Travel charged to sponsored projects conforms to the regulations and restrictions placed on the use of the funds by the sponsor

- The University upholds its obligations to steward funds by avoiding excessive or inappropriate spending

- Departments can control how their budgets are expended

Applicability

These directives apply to an official University Traveler which includes all employees (faculty, staff, employed students) and non-employees (non-employed students, independent contractors, and guests) conducting official business travel on behalf of the University of Florida.

University Travelers who are traveling within the context of their job responsibilities and/or representing the University are considered to be on official UF business travel.

Official Business Purpose

The official business purpose of UF business travel supports activities that contribute to

any one of the University’s major mission pillars of teaching, research, or public service.The official business purpose (i.e., Benefit to Grant or University/Description of Travel) should encompass all segments of your trip and should clearly establish why the specified travel or expense is occurring, not just restate the travel or expense description.

- Example: “Attendance at the GAToR (Gathering of Artificial Intelligence Technicians or Researchers) workshop where Professor Nelson presented his paper on An Analysis of Machine Learning in Scholarly Writing. The workshop supported Professor Nelson’s research on NIH (AWD0000), approved by the sponsor.

Documentation should adequately support the business purpose and align to the funding source, such as agendas or travel itinerary. Examples include the following:

- Agendas containing the event name, location, beginning, and ending times

- Daily itineraries noting location, time of activity, and business purpose

- Meeting attendee list, agenda, and purpose of the meeting

Both the official business purpose and supporting documentation should provide sufficient detail needed for an independent party to easily determine the reason for the transaction and its benefit to the University.

Compliance

Violations of these directives may result in one or more of the following depending on the severity and/or frequency:

- Delay or denial of expense reimbursement

- Loss of approver or delegate responsibility

- Restitution for personal/unallowable expenses charged to a PCard

- Disciplinary action, up to and including termination of employment

Examples of violations include but are not limited to:

- Requesting reimbursement for personal purchases

- Purchase of items defined as unallowable/not reimbursable

- Submission of travel and business expenses without sufficient or accurate receipt documentation

- Not reimbursing the University in a timely manner for unused advances or personal charges made with a PCard

Roles and Responsibilities

All official University business that involves continuous travel of 24 hours or more or which involves an overnight absence from the University Traveler’s official headquarters requires trip pre-approval. Travelers are responsible for obtaining an approved UF GO Travel Request prior to booking, making travel-related purchases, and/or departing on official business travel. Travel Expense Reports should be submitted no more than 60 days after trip completion to avoid taxable consequences to the traveler (See IRS Publication 463). Units are responsible for maintaining a system of internal controls to monitor all spending, including travel and business expense reimbursements, and should ensure that faculty and staff spending University funds are aware of and understand the University’s directives and policies (See

UF Board of Trustees Internal Control Principles). This includes monitoring expenditures for potential fraud, waste, abuse, or financial mismanagement (See UF Regulation 1.500).

University Travelers

University Travelers are responsible for:

- Understanding related policies & directives to ensure compliance and prudent spending of University funds (Note: Travelers whose expenses will be charged to a sponsored project need to also be familiar any additional sponsor restrictions)

- Providing an official business purpose that encompasses all segments of the trip which clearly describes why the specified travel is occurring and how the related expenses directly benefit the University funding sources(s)

- Providing all supporting expense documentation, including itemized receipts when required, to demonstrate the amounts incurred are reasonable based on the facts and circumstances for each travel expense

- Certifying the timely completeness and accuracy of Travel Requests and Expense Reports

The University Traveler may authorize a Delegate to prepare the Travel Request or Expense Report on their behalf; however, the University Traveler must certify electronically in UF GO that the Travel Request and the Travel Expense Report is complete and accurate prior to submission.

When an individual other than the University Traveler prepares the Travel Request or Expense Report on behalf of the University Traveler, the University Traveler is responsible for providing all appropriate information necessary for preparation.

The Delegate is responsible for:

- Confirming the nature and official business purpose of each expense

- Verifying completeness of documentation and accuracy of expense allocation to the appropriate ChartField(s)

- Entering all Travel Request or Expense Report fields necessary for efficient and appropriate review

Supervisors

The Supervisor’s role in UF GO is to review and approve their direct report’s Travel Requests and Cash Advances by ensuring the official business purpose is clear, that the trip is necessary, and that estimated expenses are reasonable and allowable. The Supervisor role in UF GO is determined from whom the University Traveler’s supervisor is listed in the University’s Human Resources (HR) data. Following Supervisor approval, Travel Requests and Cash Advances are routed to Financial Approver.

Supervisors may choose to delegate their responsibilities (i.e., allow another University employee to act on their behalf) in UF GO on a permanent or temporary basis. It is critical to understand that granting permission to a Delegate does not absolve the Supervisor of their responsibility if the Delegate does not correctly perform their duties.

Financial Approvers

Financial Approvers review and approve Travel Requests, Cash Advances and Expense Reports in UF GO. Prior to approving, Financial Approvers are responsible for:

- Reviewing documentation to ensure that the transaction is appropriate, accurate, and complies with applicable laws, policies and procedures

- Ensures expenses are allocated to their budgets accurately (i.e., Correct chartField information and funding is available)

- Questioning unusual items, and returning the Travel Request, Cash Advance, or Expense Report to the University Traveler for corrections or additional supporting documentation when needed

- Ensuring ultimate completeness of the Travel Request, Cash Advance or Expense Report and that all “Warnings” identified have been addressed

Note: “Warnings” are rules that have been built into UF GO to automatically alert when an entry falls outside of an expected parameter (e.g., missing receipt documentation, high dollar amounts, required field not populated, possible policy/directives violations, etc.)

To ensure appropriate segregation of duties, Financial Approvers are not able to approve their own Travel Requests, Cash Advances or Expense Reports. In UF GO, a Secondary Approver is assigned to ensure that the Financial Approver has an appropriate reviewer for their own travel.

Optional Ad-Hoc Approvers may also be designated and manually inserted at any stage in a Travel Request, Cash Advance, or Expense Report workflow for an additional level of oversight. Additional Ad-Hoc approvers are selected at the unit level during the approval workflow process.

A Financial Approver may choose to delegate their responsibilities for review and approval to another employee. Approval authority may be delegated; however, the assigned departmental Financial Approver remains fully responsible for transactions executed under the delegated authority. Financial Approvers should be mindful when selecting an individual whom they wish to grant their authority, as this Delegate should have appropriate knowledge and authority to act on their behalf. (Note: Any delegation will be recorded in the audit trail of the transaction).

Traveler Types

University Travelers

University Travelers include any individual conducting official business travel on behalf of the University of Florida to include the following:

Individuals employed by the University:

- Employed Faculty (i.e., Salaried and Temporary)

- Staff (i.e., TEAMS, OPS, USPS)

- Employed Students (i.e., Graduate Assistants, Student Assistants, Federal Work Study)

Individuals not employed by the University:

- Faculty not employed by UF (i.e., Emeritus and Courtesy)

- Students not employed by UF

- Volunteers

- Independent Contractors

- Prospective Employees

- Other Guests (i.e., Guest Speakers)

University Travelers who are not employed by the University are considered guest travelers and may be provided access to UF GO as a Person of Interest (POI) (See UF GO Toolkit – Creating a Person of Interest). Guest travelers who are not designated access to the system may have travel processed in UF GO by a Delegate.

Other considerations for specific traveler types are provided in the following subsections.

Student Travelers

Travel expenses of students who travel as employees or on behalf of the University may be reimbursed and processed via UF GO when reasonable and consistent with UF directives and policies.

Payments for student travel are generally considered reimbursement (i.e., not considered financial aid nor IRS ramifications) if the University is the primary beneficiary of the travel:

- The primary purpose and original intent is for the University to obtain useful results from the project/research

- Results or research will be used by the University

- Research is performed to fulfill University’s obligations to outside funding entity

- Student is presenting or actively participating in a conference or competition on behalf of the University

Examples of reimbursement:

- Student travels to represent the University in a scholastic competition.

- Student travels to present at a conference, where the student’s name is published (poster, website, brochure) as a presenter/contributor at the conference.

- Student travels to perform research, which happens to be the topic of her dissertation. The University would otherwise perform research on this topic, regardless of the student’s research – the University is the primary beneficiary.

Payments for student travel, not processed through UF GO, are generally considered to be financial aid (i.e., not reimbursable expenses for the benefit of the University) if:

- Reimbursement is made for activities in which the University is relatively disinterested or the research is student led

- The project/research’s primary purpose and original intent is to further the student’s education or training

- The University obtains little or no benefit

- The primary purpose of travel is to contribute to the student’s personal skills related to their studies

Examples of University payments for student travel that would be considered financial aid:

- Student travels for dissertation research which is not research the University would otherwise conduct – the student dissertation is the primary purpose of the travel – the student is the primary beneficiary.

- Student travels to a conference as an attendee and does not present/contribute in an official capacity.

- Student travels oversees for language training which will assist in language proficiency needed for degree. This is supplemental work that the student may need to succeed, but it is not a required part of the degree.

Any payments for student travel generally considered to be financial aid must be processed though Financial Aid and Scholarships. Questions regarding payments for student travel should be directed to Student Financial Aid and Scholarships prior to booking travel.

Presenters, Performers, Artists or Consultants

Non-University presenters, performers, artists or consultants traveling on University of Florida business may be reimbursed for reasonable and necessary business expenses. Provisions for such reimbursements should be included in any applicable agreement. Provisions not authorized by contractual agreement should be approved in advance by unit leadership.

These non-employee travelers must be informed of the University’s travel directives in advance of their travel. Expenditures that do not comply will not be reimbursed and are not advanced prior to the trip. These expenses should be supported by documentation demonstrating a direct reimbursement of expenses, as unsupported payment amounts are subject to be reported as taxable income (i.e., IRS 1099 form).

When travel is included as part of an honorarium engagement or transaction, direct travel arrangements and travel expense reimbursements are processed in UF GO. Travel allowances (i.e., not direct travel expense reimbursements) are not processed in UF GO, but rather are to be included in the honorarium payment.

Examples of Honoraria-Related Travel Handling:

- Option 1: $4,000 honorarium is processed for payment to guest speaker where University unit will be arranging the speaker’s travel on their behalf. Travel Request with estimated cost of $1,000 is processed in UF GO. Once approved, travel booking and Expense Report is processed through UF GO on behalf of the guest speaker.

- Option 2: $5,000 honorarium is processed for payment to a guest speaker, where $4,000 is indicated as token of appreciation and $1,000 is provided as a travel allowance. The speaker is responsible for making their own travel arrangements.

- Option 3: $5,000 honorarium is processed for payment to a guest speaker, the speaker is responsible for making their own travel arrangements.

For more information on honoraria payment processing, see Disbursements Directives – Honoraria.

Prospective Employees

Travel for prospective employees and their families may be authorized by the unit for reimbursement. Reimbursements for authorized travel expenses such as airfare, hotel, and meals incurred during the recruitment process are not taxable to the prospective employee.

Relocation and moving expenses as part of a new faculty or staff offer of employment is not processed in UF GO, but rather coordinated by Procurement Services with the contracted carrier, the relocating faculty or staff member, and the funding unit (See Procurement Directives – Moving Expenses). When a new faculty or staff member may elect to move their own household good themselves using a company they personally choose (i.e., self-move), reimbursement is processed through payroll where an amount may be considered taxable by the IRS (See Payroll Directives – Receiving Reimbursement for Moving Expenses).

Volunteers

A volunteer is any person who, of his or her own free will, provides services to the University with no monetary or material compensation, on a continuous, occasional, or one-time basis. Travel expenses of volunteers who travel on behalf of the University may be reimbursed when reasonable and consistent with UF directives and policies when it can be clearly established that:

- The travel is in the conduct of a University business activity

- The travel is at the specific request of the volunteer’s responsible UF employee

For more information on designations and responsibility over UF volunteers, see UF Policy – Volunteers.

Travel Classifications

Domestic vs International Travel

Travel is classified as either domestic or international for expense and reporting purposes. This classification depends on the location of the primary activity for which travel is taking place. It is important for University Travelers or their Delegates to accurately classify travel for appropriate routing and review.

Certain sponsors or other funders may use variations of the below classifications (e.g., an agency including Canada as “domestic travel”). However, for processing purposes in UF GO, the below classifications are controlling. Any reporting requirements to external sponsors or funders remain in effect and are to be monitored and verified separately by the responsible unit for consistency with agency requirements.

Domestic Travel

Domestic travel is classified as travel within and between any of the 50 United States, District of Columbia, Puerto Rico, U.S. Virgin Islands.

For domestic travel, travelers are allowed up to one (1) day to reach their destination and up to one (1) day to return to official headquarters.

International Travel

International travel is any travel outside those specified above as domestic. All expenses related to a trip to an international destination are considered international (e.g., driving to a domestic airport for a flight to an international destination is considered international travel). For international travel, travelers are allowed up to two (2) days to reach their destination and up to two (2) days to return to official headquarters.

All international travel by University Travelers (i.e., University of Florida faculty, staff, students, volunteers, independent contractors, or other non-employed guests) which includes airfare, lodging, and/or per diem is reviewed and pre-approved by the Research Integrity, Security & Compliance (RISC) office, or their designee, as required by Florida law, through UF GO.

Once the UF GO Travel Request (i.e., pre-trip approval) is received, all international travel must be registered using the UF International Center (UFIC) International Travel & Insurance Registry to ensure appropriate insurance coverage and potential emergency services are provided while on official University business.

State of Florida Definitions

The official headquarters of a University Traveler shall be the city or town in which the assigned or responsible unit office is located except for the following instances (Fla. Stat. § 112.061(4)):

- When in the best interests of the University and not for the convenience of the individual, the official headquarters of an individual may be the city or town nearest to the area where the majority of the person’s work is performed.

- When a University employee is stationed in any city or town for a period of over 30 continuous workdays, following that period, such city or town shall be deemed to be the employee’s official headquarters.

- When a Traveler has been temporarily assigned away from their official headquarters for an approved period extending beyond 30 days, they shall be entitled to reimbursement for travel expenses at the established rate of one round trip for each 30-day period actually taken to their home

The State of Florida has further defined three types of travel (Fla. Stat. § 112.061(5)) for treatment of travel reimbursement computation, detailed below:

- Class A: Continuous travel of 24 hours or more away from official headquarters. The travel day for Class A travel shall be a calendar day (midnight to midnight).

- Class B: Continuous travel of less than 24 hours which involves overnight absence from official headquarters. The travel day for Class B travel shall begin at the same time as the travel period.

- Class C: Travel for short or day trips where the traveler is not away overnight from their official headquarters.

Travelers will not be reimbursed for Class C meals.

Personal Travel

If personal travel is included in a business trip, the primary purpose of the trip must be for official UF business. When personal and business travel is combined, personal time must be disclosed and approved when the trip is authorized in UF GO.

Expenses reimbursed by the University may not exceed the lowest available cost of a direct or uninterrupted route. If the traveler uses an indirect route or interrupts travel by direct route for personal convenience, any additional expenses incurred will be the sole responsibility of the University Traveler. For more information on handling of trips combining personal travel see “Cost Comparison” section of these directives.

No-Cost Travel Paid by a Third Party

Travel paid by a third party, otherwise referred to as “no-cost” or “comp” travel, is domestic or international travel conducted in an official University capacity by the University Traveler that is reimbursed completely or in part by a third party, including travel paid for by the University Traveler.

Travel related to an individual’s assigned University research, clinical, teaching, administrative, or service responsibilities (i.e., inside activities) paid by a third party should be properly authorized, documented, and processed through UF GO, even when there is no cost to the University.

Common examples include travel in connection with a speech, conference, presentation, or meeting where a non-University host has agreed to cover all or part of the cost of the University Traveler’s expenses:

- Speaking at a conference or seminar

- Travel to receive an academic award or honor

- Reviewing proposals for a US federal or state government sponsor or a domestic non‐profit organization

- Participation in study sections, program reviews, or accreditation reviews

- Any other inside activities (See Inside Activity Decision Tree)

- Travel funded by the University Traveler which includes working abroad in an international location

Prior approval via a Travel Request in UF GO ensures the Traveler’s supervisor and/or unit leader is aware of the activity and that appropriate insurance coverage is provided for international travel (See International Travel & Insurance Registry).

To ensure compliance with BOG regulation 9.012, “comp” travel either to or paid for by a Foreign Country of Concern (COC) as defined in Florida Statute 286.101 is prohibited. While certain travel may be allowable, such as attending or speaking at a conference, the employee or University cannot accept comp travel or any other form of compensation in connection with the trip.

Additionally, prior approval or reporting to a sponsoring agency may be required pursuant to the terms and conditions of the agreement when “comp” travel is related to the scope of work of an extramurally funded sponsored project.

For travel expenses that will be reimbursed by a third party, the prevailing rules and limits of the third party may be applied to the official travel when specified and documented within the Expense Report. For example, business class travel or higher per diem rates may be allowable for reimbursement if approved and documented by the sponsoring institution/entity. Booking travel via UF GO is not required where a third-party entity is handling travel arrangements.

If a third party is paying for travel, those expenses are not also eligible for personal reimbursement by the University of Florida. The University Traveler must reimburse the University for any travel-related expenses incurred by the University and ultimately paid by another entity.

Travel Requests and Booking

Travel Requests

Travel Requests are used to plan, organize and request approvals for University business travel, and are intended to be estimates of all anticipated costs. The Travel Request performs budget checking, encumbers funds, obtains Supervisor authorization for travel, and routes for additional review and approvals based on the nature of the trip.

All Class A and Class B business travel is to be approved in advance using a Travel Request in UF GO including trips partially or wholly paid by a third party (even when self-funded); Class C (i.e., daytrip) travel does not require a Travel Request.

Travel Requests should be completed prior to departing or making any travel arrangements, with one Request per each trip. Following trip completion, a Travel Expense Report which references the approved Travel Request is prepared by the Traveler or their Delegate to request reimbursement and release funds encumbered by the Travel Request.

Cash Advances

It is best practice to make direct payments for goods and services; however, Cash Advances may be provided to University Travelers to cover costs while on official UF business when it is not practical to use a University PCard, Voucher, or Air Card to pay for travel-related expenses.

For example, a Cash Advance may be provided:

- For an extended out-of-area stay or field site assignment

- When travel requires stay in a remote location where banking/automatic teller machines (ATM) are not readily available

- The University traveler may need to cover expenses for group travel

Cash Advances can be requested by employees for persons authorized to travel on official UF business.

Cash Advances cannot be issued where the objective is to reimburse expenses paid in advance of a trip (e.g., University traveler choosing to use a personal form of payment and seeking to be reimbursed prior to trip completion). Cash Advance recipients and their responsible units acknowledge and agree to the business responsibility for monitoring and settling the advance when approving the Travel Request with a Cash Advance request.

Requesting a Cash Advance

Cash Advances are requested through a Travel Request in UF GO. Travel Requests using sponsored program funding sources (201 and 209) will be routed to the Contracts & Grants office for additional approval. UF core offices may decline to issue a Cash Advance if a determination is made that it would not be in the best interest of the University.

Cash Advances can be requested at any time with a Travel Request and will be issued by the Travel Office 30 days prior to the travel start date. If the issuance of the Cash Advance is required more than 30 days prior to travel, a written justification is to be included with the Travel Request.

Multiple Cash Advances may be allowed, with prior Travel Office approval, for different trips.

Settlement of a Cash Advance

A Cash Advance should be settled within 10 workdays from the trip end date. If the Cash Advance is not settled within 30 workdays, the University may garnish a traveler’s wages through payroll deduction. Cash Advances resulting in payroll garnishment will disqualify the traveler from future Cash Advances. Serious violations of Cash Advance directives may result in disciplinary action, up to and including termination of employment.

At the time of a Cash Advance settlement, the unit associated with the Cash Advance assumes responsibility for any expenditure that is disallowed by the sponsor or in an event of employee termination without accounting for an outstanding Cash Advance settlement.

Cash advances should be refunded immediately when an authorized trip is canceled or indefinitely postponed.

Booking Travel

All official UF business travel should be booked by University Travelers and their Delegates through the UF GO booking tool or with World Travel Service, the University’s approved travel management company (“authorized travel agent”).

Established Exceptions

At times, it may be impractical to use the booking tools offered by the University due to system limitations. Alternate booking outside of UF GO or with the University’s authorized travel agency may be permissible for reimbursement for documented instances, including when:

- A hotel offers a discount code to be used with a conference block where a hotel website must be used to enter the code directly

- Rental properties (AirBnB, Vrbo, campgrounds, etc.) that cannot be found in the booking tool result in lowest cost to the University and include a cost comparison

- Air travel to an international location where Authorized Travel Agent cannot provide support or a supplier does not accept a University PCard or other UF forms of payment (ex. Airfare in a remote international location)

- A University Traveler uses miles/points to upgrade the airfare from coach/lowest cost to their preferred airfare class and this results in a less expensive airfare ticket than the amount the University would have paid for coach/lowest cost

- If a guest (non-profiled traveler) is booking their business travel, they are not required to use the booking tool

Violation of this directive may result in delay or denial of expense reimbursement, loss of approver/delegate responsibility, restitution for personal/unallowable PCard charges, and/or disciplinary action, up to and including termination of employment.

Additional Exceptions

Every effort should be made to use the University Booking Tool. In cases not covered by the exceptions listed above, follow the procedures outlined in the UF GO Booking Tool Exception Process document.

UF GO Booking Tool Exception Process

Booking Travel for a Companion

If a University Traveler will be traveling with a companion, the companion’s ticket can be booked through the University’s authorized travel agent to obtain adjoining seats. If the companion is not affiliated with the official business trip (e.g., spouse, partner) that companion’s fare can be purchased using personal funds at the time of booking.

Paying for Travel

The University’s preferred methods for making travel reservations and paying for travel related expenses is the UF Air Card or PCard (purchasing card). Travel expenses made by other means, including personal credit cards, are only reimbursable after trip completion.

Air Card

The University of Florida’s Air Card is a virtual credit card that is an available form of payment for airfare and airfare agent fees only. The Air Card is available for all air travel when using the UF GO booking tool or the University’s authorized travel agent. The benefits of the Air Card include:

- Available automatically in UF GO profile

- No single purchase limit per airfare ticket

- Reduces monetary burden to the Traveler

Purchasing Card (UF PCard)

Whenever possible, University Travelers or their Delegates should use a PCard for all other travel-related purchases. PCard utilization allows the University to be billed directly for expenses and integrates transactions directly to a UF GO Expense Report for reconciliation.

Frequent travelers should have a University PCard to efficiently process travel expenses in UF GO. When a PCardholder, other than the University Traveler, makes travel related PCard transactions on the Traveler’s behalf, a separate Expense Report is created that must be processed in addition to that of the Traveler’s (See Managing Travel Expense Reports When You Book Travel on Your PCard for Other Employees).

For additional information about the PCard program and guidance on how to obtain a PCard visit the UF PCard website.

Cost Comparison

Any trip that includes costs for upgrades, convenience, and/or personal travel will require a cost comparison to ensure that the University is not paying for costs unrelated to or unallowable on official UF business. This includes personal extended stays at the business location, personal deviations to a non-business location in conjunction with an official business travel, and non-reimbursable travel upgrades.University Travelers or their Delegates should obtain a cost comparison through UF GO’s online booking tool or the University’s authorized travel agent at time of booking to validate the reimbursable of the business-only equivalency of the fare. This cost comparison is to be included as supporting documentation on the Travel Expense Report when personal travel and/or upgrades are included.

Cost comparison supporting documentation should:

- Represent the cost of the most direct route to and from the business location for the days of business travel only (i.e., reflect the business trip as though no personal travel is included)

- Select the least expensive airfare within the main cabin class (e.g., economy, coach)

- Not be limited to results from a particular carrier or number of stops

Note: If an airline automatically grants an air class upgrade based on traveler status and there is no cost to the University, the Traveler should still provide cost comparison supporting with the Expense Report.

Travel Expense Reports

Reimbursement Requests

Reimbursement requests for travel expenses are submitted through a Travel Expense Report in UF GO. The Expense Report should list all expenses incurred in connection with the official business trip, regardless of whether paid directly by the University (e.g., Air Card, PCard), a third party, or the Traveler (e.g., personal credit card). Reimbursements may not be made until after travel has been completed.

Except for Class C travel (i.e., day trips), an approved Travel Request is required to be associated with a Travel Expense Report.

Receipt Requirements

Receipts must be provided for all air, rail, lodging, and rental vehicle expenses. For all other expense types, receipts must be provided if the expense is greater than $25.00.

The University Traveler is responsible for obtaining receipts for all expenses for which they plan to have reimbursed. A valid receipt must identify:

- Date of purchase

- Vendor name

- Itemized list of the purchased items

- Unit amounts, if applicable

- Total amount

If the traveler is unable to obtain a receipt that contains all the required information, documentation should be submitted to demonstrate as many of the required items as possible. For example, a copy of the traveler’s credit or debit card statement identifying the date, location and amount of the expense, or a rental agreement, may be submitted along with a description of the purchase. When utilizing a credit or debit card statement, the card type and last four digits of the card should be included with any other private or unrelated information redacted.

A “Missing Receipt Declaration” may be completed within the UF GO Expense Report when other methods to obtain receipt documentation are not feasible.

Timeliness

University Travelers are responsible for timely submission of their complete and accurate Travel Expense Reports. Travel Expense Reports for Travelers employed by the University submitted more than 60 days after trip completion may result in the reimbursement being treated as taxable wage reported on the employee’s Form W-2 (See IRS Publication 463).

Travelers and their responsible units should also be mindful of the University’s fiscal year end deadlines. All expenses incurred should be reported in line with fiscal year end deadlines to ensure that expenses are appropriately captured in the University’s financial statements and departmental budgets for the appropriate fiscal period.

Travel Expenses

Airfare

University Travelers conducting official UF business or their Delegates are required to book airfare using the UF GO booking tool or through Word Travel Service, the University’s authorized travel agent.

Commercial airline reservations should be made when it the most efficient and economical means of travel, considering time of the Traveler, impact on the productivity of the Traveler, cost of transportation, and per diem or subsistence required. It is the expectation that University Travelers and their Delegates select the least expense airfare within the main cabin (i.e. economy class) that is consistent with business requirements while on official business. When using the booking tool, nonrefundable or refundable tickets should be purchased based on what best meets unit needs. The University will not compensate/reimburse employees or non-employees for use of personal frequent flyer miles.

It is encouraged that travel arrangement be made as far in advance as possible, as the availability of lower fares is generally greater. University Travelers may accrue their own frequent flyer mileage or other rewards points for trips taken on official UF business. Reward program incentives should not influence carrier selection or other individual business travel decisions.

An upgrade above main cabin is allowed in the following instances:

- If total flight time (in air) is over 9 hours, the trip is eligible for upgrade using University funds

- If an ADA accommodation is documented through the Office for Accessibility and Gender Equity prior to booking travel

- If the University Traveler personally covers the cost of the upgrade

Note: Sponsor and other fund restrictions may be more restrictive than the University’s airfare upgrade guidelines and must be followed when applicable

First Class

Generally, first class tickets are not allowed unless the traveler has an approved ADA accommodation and/or the use of personal reward points (not reimbursable by the University) make the ticket more economical than a main cabin ticket.

Other Upgrade Accommodations

University Travelers may choose to upgrade the level of air class (e.g., Comfort+, First, or Business Class) without University reimbursement.

When upgrading using

- personal funds, contact World Travel Service or the airline directly

- frequent flyer miles or other reward program, contact the airline directly

Use of University PCard or Air Card for unauthorized upgraded airline tickets constitutes a violation of this directive.

University travel shall generally be conducted via the most direct route. If a Traveler chooses a multi-destination or otherwise circuitous air route for personal reasons, the Traveler will be reimbursed only the amount that round trip airfare to and from the business event would have cost. Documentation must be attached to the Expense Report to clearly separate the cost for an upgrade or personal trip duration from the portion that is eligible for reimbursement. (For documentation requirements, see “Cost Comparison”).

Certain University Travelers authorized to utilize non-commercial aircraft require documented pre-trip approval prior to arranging the use of University-owned aircraft or any leased or chartered aircraft on behalf of the University enterprise. For guidance on applicable procedures, please contact the Controller’s Office.

E-Credits

E-Credits from a prior business trip that is supported by an approved Travel Request will be reimbursed either in full or in part depending on the form of payment used on the original purchase of the airline ticket. Credits from canceled business trip should only be used for a future upcoming business trip and should not be used for personal travel.

The University will not compensate/reimburse employees or non-employees for use of personal frequent flyer miles.

Booking with E-Credits

To book with existing business e-credits obtained while using the booking tool, travelers or delegates must call World Travel Services directly.

Note: E-Credits from a canceled business trip prior to UF GO must be supported by an approved Travel Request and booked with the airline directly. Reimbursement in full or part will depend on the form of payment used on the original ticket purchase.

Ground Transportation

Rental Vehicles

University Travelers requiring a rental vehicle during official business domestic travel, should utilize the UF GO Booking Tool to reserve with AVIS/Budget under the State of Florida’s rental vehicle contract (i.e., “Most Preferred” vendor). If AVIS/Budget is not available or a truck rental is needed, University contracted rates are also integrated for Enterprise/National and Hertz Rental cars (i.e., “Preferred” vendors). If the required vehicle is not offered by any of these contracted partners, an alternative vendor may be selected in the Booking Tool with written justification provided in the Travel Expense Report.

For international travel, vehicles should be rented only from legitimate, licensed, insured, and regulated agencies abroad. When renting a vehicle internationally, it is recommended that coverage for accident insurance, personal insurance and roadside assistance be purchased from the rental provider in that country.

Allowable rate class is up to the cost of a compact/economy car from the selected vendor. Vehicles in a higher rate class require a business justification (e.g., vehicle shared with multiple University travelers, transporting materials or equipment) or documentation from the vendor that a lower rate was charged. The rental of a hybrid will be allowed without justification. Any additional expenses associated with a vehicle rental, incurred for personal reasons such as an upgrade for personal preference, personal accident insurance, or use of rental vehicle during personal travel days, will not be reimbursed.

Fuel costs associated with the use of a rental vehicle for official business may be reimbursed when proper supporting documentation is provided. Travelers should have a valid business reason for retaining a rental vehicle for an extended period of time. For instance, a traveler who attends a conference for several days and stays at the hotel where the event is being held would not likely need to retain a vehicle for the entire stay.

For more information regarding State and University vehicle rental contracts for both business and personal use, visit Resources: Rental Vehicles.

Use of Personal Vehicle

The use of a personal vehicle for official University business will only be reimbursed up to the State of Florida mileage rate, currently $0.445 per mile (Fla. Stat. § 112.061 (3)). This rate covers the cost of fuel, maintenance/repairs, insurance, transportation, and operating costs; thus, when a Traveler is reimbursed the State of Florida mileage rate, these separate costs are not also reimbursable. To determine mileage for use in reimbursement calculations, University Travelers or their Delegates are to use the “Mileage Calculator” feature embedded within the UF GO Expense Report (See Enter Personal Car Mileage)

In addition to the mileage rate allowance, tolls and necessary parking charges may be reimbursed. Traffic violations, parking citations, or other fines are not an allowable University expense.

The University of Florida generally will not allow reimbursement for on-campus mileage. On-campus transportation is provided for University of Florida faculty and staff engaged in official business at no cost. For eligibility and coverage information, visit the Campus Cab website. In addition, Travelers shall not be paid a mileage allowance for travel between their residence and their official headquarters or regular work location.

If a Traveler elects to be reimbursed fuel receipt(s) instead of the mileage allowance, the amount of the fuel receipt(s) must not exceed what the State of Florida mileage rate would have been. Supporting documentation of map mileage via Google Maps or MapQuest is to be provided as a cost comparison to fuel receipt(s) submitted on the Travel Expense Report. Other operating costs (e.g., maintenance, repairs, insurance) of the vehicle are not also eligible for reimbursement using this method.

Other Forms of Ground Transportation

Travelers will be reimbursed for bus, subway, or other mass transportation, shuttle, taxi fares, or other ride services plus tips up to 20% when necessary for business purposes.

Reimbursement will be provided for transportation between hotels, railroad stations, airports, restaurants for business meals, workplaces, meetings, or other documented locations associated with the official business travel. Ground transportation to and from a restaurant for a non-business meal or for other personal reasons are not reimbursable.

University Travelers using long distance train/rail service should book fare within the main cabin class (e.g., economy, coach) that is reasonably priced, consistent with business requirements. The UF GO booking tool or authorized travel agent should be used to arrange long distance train fares when times and locations required for official business travel are available.

Travelers should use licensed transportation companies when choosing to hire ground transportation services, including ride-sharing (e.g., Lyft, Uber). For safety, travelers should use transportation providers that are easily identifiable through website or app photos of automobile, driver, and vehicle license, or that have the company name clearly displayed on their vehicle.

Lodging

Lodging reimbursement for official business travel (i.e., Class A or Class B) is limited to single occupancy unless rental accommodations are shared by more than one authorized Traveler. Any University Travelers who lodge within 50 miles of their headquarters or residence must have approval from the department/unit head prior to claiming reimbursement. Criteria for approval may include late night or early morning job responsibilities, or excessive travel time because of travel conditions.

Lodging reimbursement is limited to single occupancy unless rental accommodations are shared by more than one authorized traveler. A justification may be required for a single room rate that is unreasonable compared to market rates (room rate only) unless a conference/convention hotel rate is used.

Personal expenses, such as guest accommodations, room service, early check-in, entertainment and other non-business charges, are not reimbursable by the University.

When possible, the University recommends using a commercial hotel unless the service is unavailable or cost prohibitive. Alternative lodging options (e.g., Airbnb, VRBO, HomeAway) may be utilized by University Travelers on official business. If this option is selected, travelers must provide a cost comparison with hotels closest to the event/alternative lodging. Travelers should carefully consider the ability of a particular vendor to provide complete, reliable, and safe accommodations when making travel arrangements and take special note of cancellation policies and any other terms of agreement. (Note: If UF is making a payment directly to the leasing company/owner an Agreement Intake Form in myUF Marketplace is to be routed for UF Procurement’s execution)

Costs for lodging associated with a meeting, conference, or convention organized or sponsored in whole or in part by a state agency or the judicial branch may not exceed $175 per day when paid with State Appropriations or sponsored project funds from State sources. Amounts exceeding these limits may be paid through an alternative funding source. (State of Florida Appropriations Bill, HB 5003)

When this limit applies, the University Traveler or Delegate should add in the notes section of Travel Expense Report that the event is organized or sponsored in part or in whole by a State of Florida agency, a State of Florida college/university (including the University of Florida) or the Judicial Branch of Florida.

Travel Meals and Per Diem

Travel meal and per diem rates are pursuant to State of Florida Statute 112.061, where a University Traveler may choose whether to be reimbursed using (1) a meal allowance plus the permissible cost of lodging, or (2) a straight per diem. Only one method of reimbursement may be utilized per trip (e.g., meal allowance and lodging method may not be used for one leg of a trip with straight per diem method used in a separate leg of a single trip). Travelers will not be reimbursed for Class C meals.

For domestic travel, University Travelers are reimbursed for the actual cost of lodging along with a maximum daily meal allowance of $36.Meals for first and last days of domestic travel are based on times of departure and return as detailed below:

| Breakfast | Lunch | Dinner | |

| Meal Allowance | $6 | $11 | $19 |

| Travel Duration | Begins before 6:00 AM, extends past 8:00 AM | Begins before 12:00 PM, extends past 2:00 PM | Begins before 6:00 PM, extends past 8:00 PM |

For international travel, University Travelers are reimbursed for the actual cost of lodging along with a meal and incidental expenses (M&IE) allowance as established by the U.S. Department of State.

Within a Travel Expense Report, the UF GO “Travel Allowance” feature applies the appropriate U.S. Department of State M&IE Allowance based on the accurate entry of the Traveler’s itinerary.

Below are incidentals included on the Travel Allowance that cannot be itemized separately:

- Laundry services

- Maid service

- Portage

- Taxi/Rideshare Tip

Meals provided by a meeting, conference, or event as indicated in the agenda, or otherwise paid by the University or a third party must be deducted from the daily meal allowance. Receipts for meals are not required to be provided when the meal allowance reimbursement method is utilized.

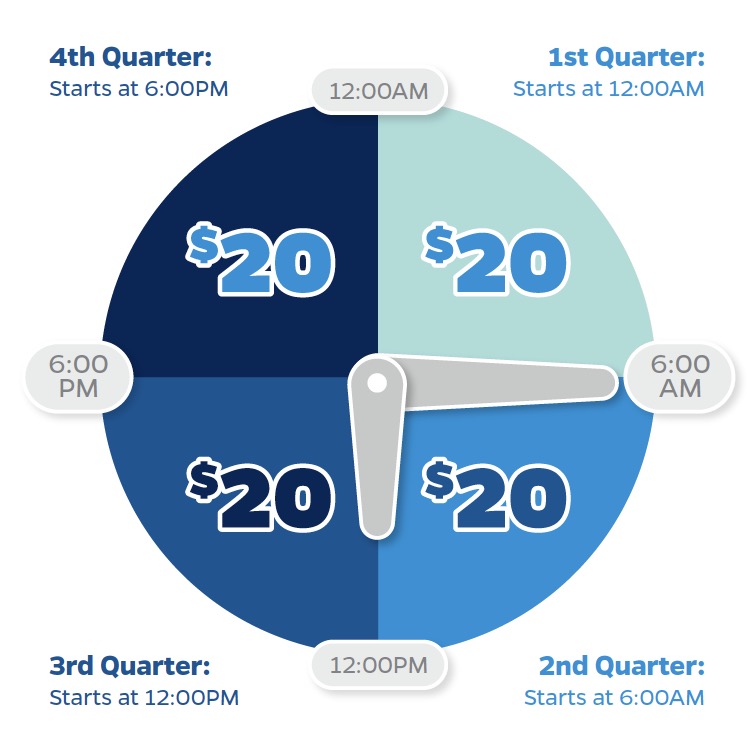

In lieu of reimbursement for actual expenditures, University Travelers may alternatively choose to be provided a maximum per diem allowance of $80. The traveler shall be reimbursed one-fourth of the authorized rate of per diem ($80/day) for each quarter of the travel day included within the travel period. If the Traveler is in any portion of a quarter, they will receive that quarterly allowance of $20. The quarters are as follows:

- 1st quarter starts at 12:00 AM

- 2nd quarter starts at 6:00 AM

- 3rd quarter starts at 12:00 PM

- 4th quarter starts at 6:00PM

Taxes

Sales Tax

The University is a tax-exempt organization and is exempt from paying sales tax in the State of Florida. Certain travel expenses incurred may be exempt from state sales tax, provided:

- The University holds a state sales tax exemption certificate in the state of travel; and

- The University makes payments directly to the hotel or other vendor using a UF PCard or UF invoice payment

Travelers may be required to present a copy of the Sales Tax Exemption Certificate to obtain the applicable sales tax exemption. Some states outside of Florida may honor the University’s tax-exempt status, although they are not required to do so.

Note: If a Traveler or their designee pays for travel expenses out-of-pocket, sales tax paid is an allowable reimbursable expense.

Value Added Tax (VAT)

Value Added Taxes (VAT) imposed by many countries outside of the United States, is a broad-based consumption tax assessed on and added to the value of goods and services.

University Travelers on official business who purchased goods and/or services that included VAT may be eligible to seek VAT reimbursement (e.g., research exemptions) following the country’s specific reimbursement process. To ensure the University and/or sponsoring agency is properly credited, when a VAT reimbursement is received, the Traveler must repay the University for any amounts claimed on the Expense Report (See Expense Refunds).

Other Related Expenses

When related to official University business, appropriately documented, and permissible on the associated funding source, the following expenses may be considered allowable travel expenses eligible for reimbursement:

- Conference/meeting registration fees (See “Memberships” Directive for guidance on allowability when combined with a registration fee)

- Reasonable telephone costs and Internet charges when needed for official University business

- Parking when a necessary part of the business trip (e.g., airport parking, parking at business destination)

- Fees for a travel visa or currency conversion

- Costs for vaccinations and medications required for travel to specific locations

- Laundry and dry-cleaning expenses when travel has extended beyond 7 days, and for each subsequent 7 days of official business travel

- Tips and gratuities, up to 20% pre tax, and when accepted as standard practice (e.g., restaurants, ground transportation, etc.)

- Valet parking when mandatory or when the location does not offer a less expensive parking option

Note: When traveling internationally, fees and tips given to porters, baggage carriers, hotel staff, and staff on ships are included in Meals & Incidental Expenses (M&IE) allowance rates and cannot be claimed separately (The Federal Travel Regulation Chapter 300, Part 300-3).

Unallowable Expenses

The following expenses are considered personal expenses and will not be reimbursed, or otherwise paid for, by the University:

- Expenses related to family members, companions, or personal travel

- Communication expenses to contact the Traveler’s family or for other non-business purposes

- Expenses related to care of the Traveler’s family or home (e.g., childcare, pet care, house-sitting)

- Fines (e.g., parking tickets and traffic violations)

- Fees related to personal negligence without adequate justification (e.g., late or “no show” fees)

- Personal grooming services (e.g., barbers, hairdressers, shoe shines)

- Membership/dues in private clubs or reward programs

- Room service, entertainment and recreational fees, including fees for social or non-mandatory activities at conferences (e.g., tours, sports activities, etc.)

- Expenses that will be paid or reimbursed by a third party

- Any other expense that is personal in nature without a clear business purpose

Special Considerations

Funding Source Restrictions

Sponsored Project Funding

University Travelers using sponsored project funding to cover travel expenses, as well as their Delegates and Approvers, should be aware of and comply with the specific requirements of the grant or contract. Expenses must directly benefit the scope of work of that project and be reasonable, allocable, and allowable (See Cost Principles Directives & Procedures).

Travel using a sponsored project funding source may be subject to specific limitations and restrictions set by the sponsor(s) and, if applicable, Federal regulations. Travel restrictions may vary between Federal and non-Federal sponsors and sponsor-specific restrictions not explicitly covered by these directives may apply.

Booking through UF GO or World Travel Service facilitates compliance with the Fly America Act, which requires the use of a “U.S. flag” air carrier when travel is paid by the Federal government. If an exception is needed for the use of a foreign air carrier on Federal funds, the Traveler or their Delegate is to submit the Fly America Act Exception Form to the UF Travel Office and receive pre-trip approval. The use of a foreign air carrier on Federal funds is not justified because of cost, convenience, or Traveler preference.

Note: Details about the rules and regulations of the Fly America Act can be found on the U.S. General Services Administration (GSA) website.

Any questions about travel limitations or restrictions for sponsored project funding should be addressed with your research administrator prior to travel.

Direct Support Organizations

Units must ensure the legitimate use of University Component Unit/Direct Support Organization (DSO) funds to include the following:

- Be reasonable and benefit the University

- Fall within the donor’s intent for the gift (as applicable)

- Not jeopardize the DSO’s tax-exempt status

- Comply with all applicable statutes and regulations

No DSO funds may be used for:

- First class travel

- Private club memberships

- Lavish or extravagant entertainment

- Political or charitable contributions

- Personal benefit to an individual (other than an incidental benefit)

Per Florida Statute § 1004.28(2)(d), the use of state funds is not permitted to pay for any direct support organization (DSO) travel. Travel by deans, faculty members and directors for fundraising purposes is considered travel on behalf of the University of Florida Foundation and, as such, cannot be paid for with State Appropriations.

Note: For additional guidance, see Directive – Payment with Component Unit Moneys

International Travel

In accordance with State of Florida mandate, Travelers must read and acknowledge through UF GO, all applicable UF regulations, policies, and directives while traveling on UF business internationally.

In compliance with U.S. export laws, if a University Traveler is traveling with University-owned property (e.g., laptop) internationally, a Foreign Travel Request via the myAssets Portal must be authorized prior to travel (See Completing Foreign Travel or Shipment Requests).

For additional information regarding processes for international travel consideration, visit Knowledge Base: International Travel

Cancelled Travel

Penalties for cancellations, such as airfare, lodging, registration, etc., may be paid from University funds only when:

- The cause for cancellation is in the best interest of the University; or

- The cancellation is due to illness of the Traveler or illness or death of a member of the Traveler’s immediate family, for which an employee would be authorized to use sick or administrative leave (See Administrative Leave)

If the travel expense is cancelled for the convenience of the Traveler, the cancellation penalty may not be paid or reimbursed from University funds.

If the cancellation is allowable for reimbursement, justification detailing the circumstances surrounding the cancellation must be attached to the Travel Expense Report. Approvers authorizing such fees must consider and identify the funding source and determine that the expense is reasonable and necessary.

Note: Credits for cancelled flights booked through the UF GO Concur Booking Tool for business travel will be available in the Traveler’s profile.

If a credit issued is associated with a sponsored project, the credit should be tracked to ensure it is used to directly benefit the same sponsored project that incurred the original cost. If the Traveler plans to use the credit for travel in support of another sponsored award or another University activity, the original travel charge must be removed and transferred to the appropriate funding source that will benefit from the travel.

Risk Management

Worker’s Compensation for Injuries Incurred During Travel

University Travelers are eligible for workers’ compensation benefits during periods of travel which are necessary to perform the official business of the University.

Travelers are not eligible for worker’s compensation benefits during activities which deviate from the normal course and scope of the official business, such as vacations or personal enterprise, even though the activities may be combined with periods of travel for official University business.

Direct any claims and inquiries regarding worker’s compensation benefits to UF Human Resources Worker’s Compensation Office.

International Business Travel Insurance

UF is committed to ensuring the health and safety of every student, faculty, and staff member while abroad on university business. To fulfill this commitment, the University of Florida International Center (UFIC) provides 24-hour emergency contact, monitors international events, informs program participants of potential health and safety issues and provides international health insurance that includes emergency medical evacuation and repatriation coverage. To receive this service all UF students, faculty and staff traveling outside the US on official university business must complete an Online Travel Registration.

Business Entertainment Policy

The University is committed to maintaining integrity and fiscal responsibility in the approval and accounting of expenditures, including University employee and guest meals or entertainment expenses that are paid by the University for business purposes. For the complete policy, please visit Policy on Business Entertainment.

General Reimbursement

General Reimbursements for expenses personally paid by University employees or other individuals conducting official business, may be processed in UF GO via a General Reimbursement (Non-Travel) Expense Report with all necessary supporting documentation to include itemized receipt(s) showing the breakdown of types of goods/services paid (See Create and Submit a Report for General Reimbursement).

Employee reimbursements should be used for small, “out-of-pocket” purchases only when the University’s preferred purchasing methods cannot be utilized.

Allowable expenses for general reimbursement include:

- Allowable business hosting expenses (i.e., food purchases, luncheons, retreats, and entertainment)

- Licenses, dues, memberships, and submission of research papers/payment for review services

- Poster, manuscript, or other material printing services

- Whenever a PCard is not accepted by the supplier

- In an emergency when it may become necessary to pay for materials or services from personal funds

Expenses that are NOT allowable for reimbursement include:

- IT Equipment. All IT equipment must be purchased using UF procurement mechanisms to ensure all applicable UF IT standards are met

- Clothing

- Contractual Services (except with approval from the Director or Associate Director of Procurement Services)

- Any other commodities or contractual services that are required to be processed on a requisition/Purchase Order (PO)

- Sales tax that would have been avoided if normal University purchasing processes had been followed